To be a little more clear than this headline would suggest, it’s not a 4% tax on millionaires. It is a 4% tax on people making over $1M per year. That’s a pretty far cry from someone who simply owns a house, retirement fund, or a stock portfolio worth over $1M. And it’s going to education and infrastructure. I would fully support this tax if I lived in the state.

Exactly. I feel like calling it a millionaire tax is some right wing nonsense.

I wouldn’t strictly call it right wing nonsense. However, I’d definitely call it classist nonsense. Bezos owns stake in Business Insider, and is owned by Insider Inc. The CEO of Insider is Henry Blodget, who has a net worth of at least $50m and received over $300m in the sale of Insider to Axel Springer SE. The CEO of Axel Springer SE is Mathias Döpfner, with a net worth of $1.2B. The founder of Axel Springer SE is Axel Springer, who was compared to Rupert Murdoch when he was alive.

deleted by creator

A lot of people learned their lesson about moving to avoid income tax in the past 3 years. Surprise, a lot of rich people and businesses ended up moving back to the states they shit on a couple years earlier. Including Elon Musk who makes waaaaay more than $1m

deleted by creator

He may do that but from the leaked tax returns he paid about 24% on $1.2 billion over a four year period.

However, it’s super dumb that his tax rate on 1.2bill is the same as someone making $80k.

deleted by creator

Is there actual evidence of this? I think FL and TX are still large net population gainers over the past few years, while MA, NY, CA all lost population. I have no idea about the net moves by income bracket though

Tesla moving back - https://www.forbes.com/sites/brianbushard/2023/02/22/tesla-engineering-headquarters-will-open-in-california-musk-announces/

More people moving to CA than leaving - https://www.cbsnews.com/sacramento/news/mass-exodus-recent-data-shows-more-people-moving-to-california/

2/3 of female employees would not relocate to Texas for work - https://commercialobserver.com/2021/09/two-thirds-of-employees-wont-move-to-texas-after-abortion-law-survey/

This article also talks about several large companies paying to relocate employees out of Texas ^

You have to keep in mind, the whole abortion thing is fairly new, but quickly taking over red states. Add that with your comp being lower in red states and people learned a lesson the hard way.

Rich people like money, but they like having rights and not freezing to death without electricity more. Ask Ted Cruz lmao

Interesting. Republicans have successfully hurt their economies with abortion.

I worked down in Texas a couple years before the pandemic. I’m very glad to have moved back to Missouri. Which should say a lot.

I know a couple dozen millionaires in Massachusetts and none of them will be leaving the state.

4% is nothing to them. Their kids have excellent schools. They enjoy great public services. Boston.

Imagine if they expanded the tax to everyone making over median income!

A man can dream.

I think that a 4% hit would be a lot for people making significantly less money.

The utility of each dollar drops the more you have. $1000 would be a massive amount of money to someone making minimum wage. $10000 in a single check might seem like a life changing amount of money for some people. At higher levels of wealth and income, those values would be far less significant. If you were to raise or reduce the salary of a typical Bay Area software developer by $1000, for instance, they probably wouldn’t even notice. And they’re not making $1M per year, either.

The reason we have things like a progressive income is that we can tax someone making $1M per year an extra $40k - as much or more than many individuals make - and it’s not going to seriously affect their spending or saving habits. If we tax someone making $50k an extra $2k, they would feel it.

I’m aware, but Americans are also dramatically under-taxed, and as a result most of our support structures are dramatically underfunded.

50k is below the third quintile so wouldn’t really be touched. Third quintiles starts at 61k.

You could probably increase it to 4.5% and have the same effect. People making above median are still working class. That also doesn’t take into account cost of living in different areas

I’m pro jacking it way the fuck up as we move through income tiers. We could just have such nice things if we raised taxes.

Ideally I’d like to see federal incentives tied to states tying their minimum wage to local COL, and significantly higher progressively-increasing taxes on everyone from the third quintile up.

Then just change all welfare that isn’t a training/education program to straight cash and we are cooking with gas.

I’d say fourth quintile but I’m personally biased and I do agree with pretty much everything you’re saying. It’s wild to me that we have a flat constant as the minimum wage and not a formula that takes into consideration your district’s cost of living. Ideally we’d have:

Min Wage for District A = Federal Constant + k*Cost of Living in A

It would need to be coupled with some sort of gerrymandering prevention so that districts were more representative of state areas. You’d need large cities to be their own district in this scheme.

I don’t think voting districts and localized COL need to be tied together, but I’d sell a kidney to fix the gerrymandering shit so yeah, still agreed.

It’s the best way I can think of defining an area for CoL without screwing someone over. On the state level it would be heavily skewed still. Maybe counties?

Note that we already pay 5% tax on income. This is effectively a second bracket for higher income

People who think all the millionaires will flee- do you really think they’ll all give up living on Martha’s Vineyard over a 4% tax?

Also, suppose some do. 4 percent tax will still generate more revenue on the remains than you will get through their creative accountants regularly

Furthermore, the ones that leave are likely the tax dodging assholes that drain the system dry while providing nothing of value. If the demand for millionaire level housing goes down, that should lower costs for all.

Must be a pretty big vineyard

I don’t know about MA’s tax rules, but it could be based on number of days living in the state. Most wealthy people are not staying on Martha’s vineyard outside of the summer.

deleted by creator

This is the best summary I could come up with:

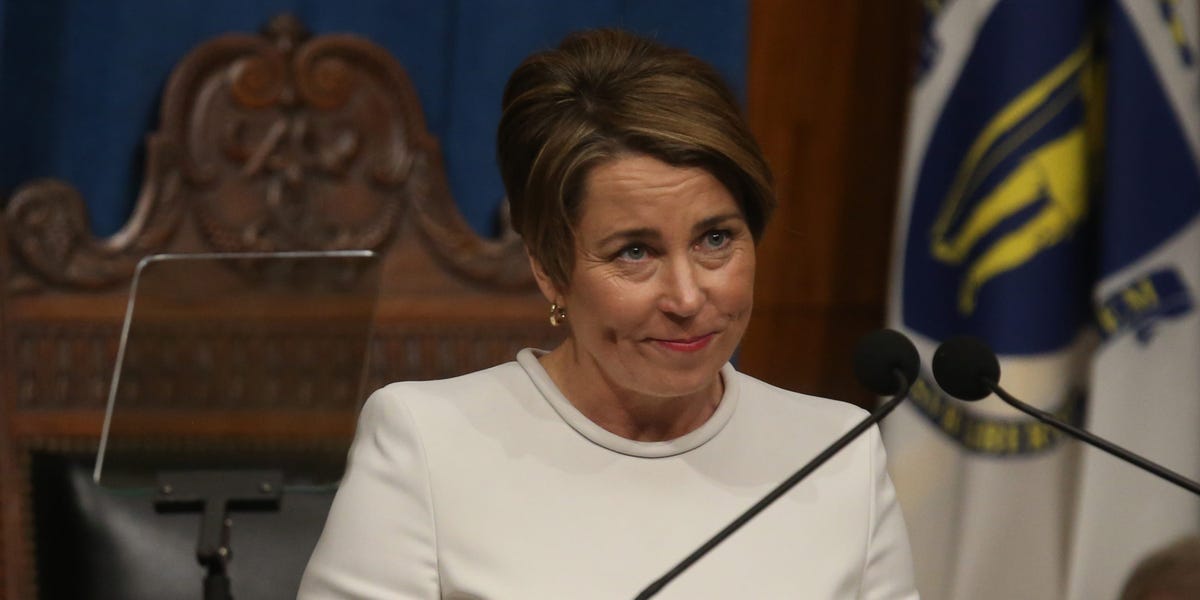

Massachusetts’ new 4% millionaire’s tax is giving a major boost to education and transportation initiatives in the state.

Maura Healey last week signed a $55.98 billion state budget for the 2024 fiscal year to spend the money.

The state’s budget “makes significant investments in schools, child care, clean energy, the environment, and access to mental and physical health care,” Healey previously said in a statement.

The signing of the budget made Massachusetts the eighth state to adopt a plan for free school lunches since the expiration of federal free school lunches that had emerged during the COVID-19 pandemic.

Here’s a complete breakdown of how the $1 billion revenue from the millionaire’s tax will be spent, according to the governor’s office:

A spokeswoman for Healey’s office told Insider: “This establishes a blueprint for how this revenue will be tracked and spent in future years on priorities in education and transportation, as directed by the voters.”

I’m a bot and I’m open source!

That’s a lot of avocado toast.

RepubliKKKlan will find a way around it.

Inflicting suffering on the young and helpless is a RepubliKKKlan Hallmark.

They’ll find ways for their “income” to be something else. But it’s a start.

I guess it’s also a good list of how to cut spending to undo those taxes

deleted by creator